AIT, so far my best performing stock

Now that I’m making tons of money fresh out of college (hah, no), I figured I better put it somewhere where it can go to work. The general consensus in investment circles is that right now, with interest rates so low, money should be invested in stocks over bonds. If you’ve got a couple hundred-Gs to blow, I’d buy property. Surfs and plebes like me, stocks.

Buying stocks is daunting. Tremendously so. I still don’t claim to understand even 20% of the subtleties of choosing a good stock. However, I did a lot of reading, and I can say with confidence that I’m not making ridiculously stupid decisions putting my money in the stocks of my choice over a simple savings account or government bond. Here’s how I went about it:

1. Know what you’re getting yourself into

There is no way you can be hand-held into investing, other than simply throwing money at Vanguard or some other mutual fund and having done with it. Don’t know what a mutual fund is? Then it’s definitely time for some surface research.

Starting off, get a basic understanding of the terms and functions of the markets. Begin with Investopedia’s Investing 101, reading start to finish and exploring any terms you aren’t familiar with. Move on to Stocks Basics and Bonds Basics. It’s important to be following hyperlinks in these articles to get a deeper understanding of each term that comes up, as things such as P/E ratio and market cap are going to be important later. After getting a basic understanding, tool around Investopedia for a couple more days to pick up miscellaneous knowledge and advice. I spent about three weeks peddling around that site alone.

Next, it’s time to tackle some heavy literature.

The most recommended book is The Intelligent Investor. Written by arguably the best investor in history, Benjamin Graham, it outlines how to treat investing not like a gamble, but like a nest egg. I found it deeply technical, but it’s good to at least struggle through it to get a better mindset of what investing in stocks is really about.

Rich Dad, Poor Dad is a contentious book, often scoffed at by property owners for Kiyosaki’s suggestion that a house is a liability, rather than an asset. I believe it’s a good read to highlight the importance of getting as many routes of incoming cash flow as possible.

Wikipedia’s list of Cognitive Biases. See also, Biaslist. The market is not rational, and you are not rational It is important to understand that this is scientifically demonstrated.

There, now you are armed with your most important tools: knowledge, patience, and foresight.

2. Get a broker

I’m going to assume you aren’t going to pretend you’re a boomtown 1950’s trader with a newfangled carphone to make snap trades on, and are going to get an electronic/online trade service. Right now there are two that are the best options for newbie traders:

Optionshouse: I use this. Fairly rich trading module with lots of auto buy and sell options, allows stocks and options. 5.00 per stock trade, no minimum balance. Easily funded with an ACH transfer.

TDAmeritrade: 10.00 per trade, regardless of balance. I’ve heard good things about their system and free stocks info.

It’d be good to do your research, possibly including reading up on some posts in the investing subreddit, before making a decision.

Once you’ve made your choice and registered and account, prepare for a couple week’s wait before you’ll be able to actually start trading. With Optionshouse, I had to scan and send in an electric bill and do an ACH transfer to fund my account before I was able to get rolling. After that was sorted, it was all smooth sailing.

3. Get a Yahoo Finance account

You’ll want this to track your stock performance. Note the “my portfolio” option. Later, when you buy stocks, you’ll use the “add/edit” holdings button. You can do it before buying stocks if you want to experiment with how you’d do with your investment plan. Make sure to input both the number of stocks you’ve purchased, along with the price at time of purchase!

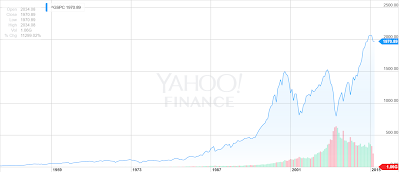

Spend some time playing around with the portfolio options, custom views, and etc. My favorite view is the “performance” one as it shows me how my holdings are doing against my original purchase prices. Yahoo Finance also gives you access to company fundamentals, charts, and etc. I don’t bother with my broker’s tools as they’re far more convoluted than what Yahoo offers for free.

4. Choose your stocks

It’s a good idea to do this well before actually putting money into your account. Since it will take a few weeks for your brokerage to clear you to fund an account, then for your funding to transfer, you have a good block of time to take a look at a couple stocks, read into their fundamentals, and sleep on them.

I go with the Graham method of investing. Namely, I never touch my savings account, and I never NEVER touch my stocks. Note that pulling a stock out before 365 days are up incurs a massive capital gains tax, so choose stocks that you’re looking for long term growth in.

Here’s a list of Graham’s stock rules, and here’s my favorite Graham-style stock screener. While I wouldn’t go and outright buy all the stocks you see on the screener, it can help you narrow down your search significantly in what you’ll end up buying. In short, you’re buying based off of value versus stock price, not some sort of hair-brained chart-watching gambling scheme you thought up.

5. Pull the trigger

Set a sane initial funding price for yourself, then a month to month investing scheme. I’m diversifying as much as possible, putting me with a couple Graham-friendly stocks (AIT and CUB), a long term blue-chip with fat dividends (IBM), stocks I have market knowledge on (CVX), and a just for fun gamble (PBR - 4 bucks a share, down from 70). I’ll be fleshing these out to healthy holdings, then look to add mutual funds, indexes, and other Graham-friendly companies in other industries.

Like many of the above books recommend, it’s all about having a long term strategy. Right now the stock market is poised on the precipice of a terrifying crash, but because I buy stocks in companies I’m confident will continue to thrive based on their past performance, how they managed their business, and the industries they’re in, I know that twenty years down the line I will absolutely have grown my savings with the companies. Assuming, of course, the world doesn’t end.

Have I chosen quite possibly the worst possible time to start investing? Time will tell!

That doesn’t stop me checking prices day to day, of course…